Secondary Navigation Menu

Home > Events > Reclaiming the Economy > The Creation of the Caisse de depot et placement du Quebec

The Creation of the Caisse de dépôt et de placement du Québec

In a few years, this fund might become the best economic planning instrument that a society might imagine having" (translation).

Quote drawn from report of the Confédération des syndicats nationaux (CSN) management committee in 1962, reported in Jacques Lacoursière's Histoire populaire du Québec, Volume 5: 1960 to 1970, Sillery, Septentrion, 2008, p. 57.

In the wake of the establishment of the Société générale de financement in 1962 and the nationalization of electricity in 1963, the Government of Quebec acquired a new instrument in 1965 to proceed with its goal of economic winback: the Caisse de dépôt et de placement du Québec. Since their accession to power in 1960, the Liberals reflected on the creation of a universal, mandatory pension plan for all Quebecers. The matter was precipitated further when, during a Speech from the Throne in 1963, the federal government announced its intention to implement a pension plan in Canada. The Quebec government marshalled it forces and Premier Jean Lesage was able to present the Régime des rentes du Québec project during a federal-provincial conference in 1964, much to the surprise of federal government delegates. Taken by surprise, Canadian Prime Minister Lester B. Pearson had no other choice but to accept the principle of a distinct plan for Quebec. The Caisse de dépôt et de placement was entrusted with the management of considerable sums intended for Quebecers' pensions. Likewise, the new organization brought together scattered and forgotten funds of the Government of Quebec such as the buyback of seigniorial rents and Protestant marriages, among others. Finally, thanks to the Caisse, the Government of Quebec was no longer submitted to primarily Anglophone corporations that formed a financial lobby to float loans.

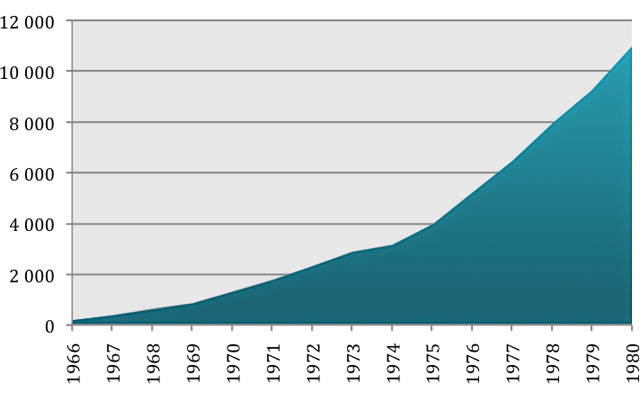

In 1964, when Jean Lesage expressed his firm intention to create the Caisse de dépôt et de placement, he estimated that its assets would reach a billion dollars in 1970, and more than ten billion in 1993. Lesage was mistaken in his long-term projections, because as early as 1980, the Caisse already managed ten billion dollars.

Total assets of the Caisse de dépôt et de placement du Québec, 1966-1980 (in millions of dollars)

| Année | Actif |

|---|---|

| 1966 | 179 |

| 1967 | 383 |

| 1968 | 653 |

| 1969 | 866 |

| 1970 | 1,321 |

| 1971 | 1,783 |

| 1972 | 2,312 |

| 1973 | 2,895 |

| 1974 | 3,168 |

| 1975 | 3,949 |

| 1976 | 5,210 |

| 1977 | 6,448 |

| 1978 | 7,910 |

| 1979 | 9,254 |

| 1980 | 10,965 |

Source: Caisse de dépôt et de placement du Québec